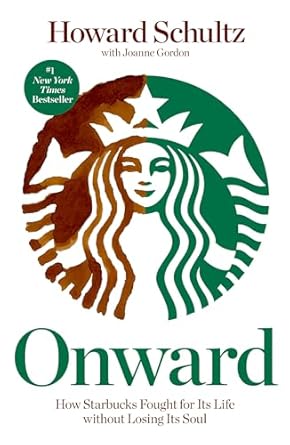

Source: The Washington Post

Geoff Di Felice & Marcus Guzzardi

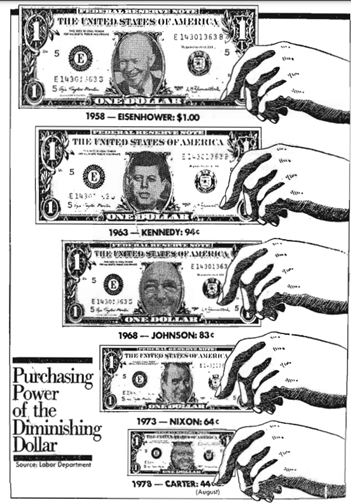

One of our favourite graphics on the perils of inflation is from a 1978 copy of the Washington Post, illustrating the purchasing power of $1.00 in 1958 had in 20 short years been inflated away to just $0.44. If you extend this exercise to 2023, what would that 1958 dollar be worth… just $0.12¹!

This brings us to the core focus of the Real Asset capital pool – we are seeking to maintain the real value of our capital over the long-term whilst also earning an attractive return. Given the significant and growing public sector debt, the potential risks to inflation will remain high for the decade ahead; from a debtor’s perspective the above arithmetic means if you borrowed one dollar in 1958, you only had to pay back $0.12 in 2023.

So what is a Real Asset and what gives them their real asset features?

We classify Real Assets as investments with highly predictable demand and inflation-linked revenues but not costs, such that the cash flows (and hence the asset value) maintain their real value. One question we like to pose to test an asset is, if the currency was to change from dollars to sheep, would it be so fundamental that it would still get paid the equivalent amount? This means these assets can transcend the financial system (as long as you hold onto your property rights…).

The concept of Real Asset investing has grown significantly over the past decade and as Wall Street and asset gathers have moved in, it has become a marketing term as much as an investing term. It’s crucial to focus on the essential characteristics of Real Assets, as “like” a Real Asset will not deliver the outcomes investors are seeking. We believe Real Assets must have all the following characteristics:

- Inflation-linked revenues and inelastic demand: revenue that is inflation-linked (contract, regulation, economics) with inelastic demand so the price increase is not offset by a volume decline.

- High margins and high fixed cost base: Inflation-linked revenues are not enough; the asset must not have a cost base that mirrors this. For example, many agriculture investments have very strong inflation protection in their revenues (driven by the commodity price) but typically this is more than offset by their cost base, which includes feed, energy and labour. Additionally, high margins allows for greater protection of free cash flow to small changes in costs.

- Long duration physical asset: this means once constructed the asset does not have to be rebuilt for many decades. As inflation increases, so too does the cost of constructing (replicating) the asset. So this will put pressure on new entrants (or keep them out), pushing up the market price or allowing the asset to increase its price.

- Focused Management Behaviour: ultimately we are investing in a corporate structure that owns the Real Asset. The structure and leadership can enhance or destroy all Real Asset benefits, for example through high-risk capital allocation and/or highly leveraged capital structures.

Historically attractive real assets have been real estate and infrastructure. They typically have inflation-linkages in their contracts or regulation, they have very high margins (typically 80%+) with a high fixed cost base and are long life assets. When we established the Endeavour Fund we observed these assets had come to be highly financialised – highly sophisticated investors, broad financial products/securities, returns that were bid down and typically employ very high levels of leverage – meaning the Real Asset characteristics had probably been diluted.

We have instead focused our Real Asset capital pool on Royalties. We have been investing in Royalties for many years over which time we have codified our approach to the asset class. We view Royalties as a highly specialised investment area due to the complex and heterogenous nature of the assets – which provides the opportunity for highly attractive returns. In particular, the greatest returns from Royalties are earned from their long-term optionality which the majority of the market lacks the patience to realise.

Overview of Royalties

Royalty assets derive their value from an underlying asset, of which they take a share of the revenue. For instance, if you owned the copyright of “Like a Rolling Stone” every time that song is played or performed you would receive a payment. Royalties have extremely attractive financial characteristics as they receive a top-line share of the underlying assets revenue but incur no operating or capital expenses to generate it. In the above example, Spotify is spending all the money to grow subscribers and the artist and record label are incurring all the expenses to record and promote the song. This can lead to some royalties having margins as high as 95%.

Royalties have been applied to a wide range of asset classes, including music and content, pharmaceutical and technology patents, precious metals (like Gold) and mining & minerals (like oil and gas). It is important to note, that while all royalties have some things in common, they are highly heterogeneous, this is driven by:

- Structure of Royalty Agreement: royalties are not a standardised securities like common equities, the terms of the royalties could be regulated, legislated, or negotiated. The duration could be extremely long (in some cases perpetual) or quite short (less than a decade);

- Underlying Asset Type: the asset type will determine many of the investment features, for instance if you own a perpetual royalty on a quality ore base there is some chance over the next 20 years an additional discovery could be found potentially increasing the value of your royalty multiple times but if you own a mature pharmaceutical royalty with three years remaining, it will provide more predictable payments and then terminate.

- Underlying Asset Quality: the underlying asset quality is of maximum importance, in particular for long term optionality and capital preservation. Eg. a classic rock music catalogue has the potential to be used in commercials, TV/Film, documentaries and find whole new generations of audience. Whereas an obscure pop hit may have less optionality.

These differences make royalties highly specialised and prospective returns amongst royalty investments widely dispersed.

Mineral Royalties

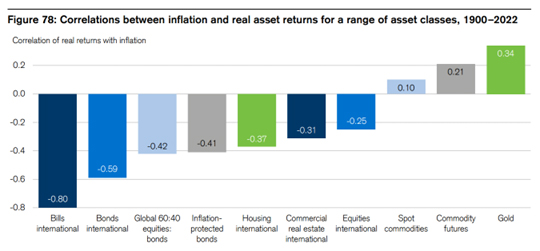

Source: Credit Suisse Global Investment Returns Yearbook 2023

We have codified and invested across all the above-mentioned royalty sub-sectors. We have concluded that mineral royalties provide very attractive Real Asset features: uncorrelated cash flows, and an inflation hedge with long-term optionality not found in other royalty categories.

As this chart from Credit Suisse illustrates, commodities provide a hedge against inflation. The cost of extracting the underlying commodity tends to rise over time, such that over the past 20 years, a broad basket of commodities has increased at a rate greater than inflation. The miner incurs this cost through higher costs but the royalty owner does not, receiving the full benefit from the higher prices. However, the market does not tend to price this, assuming long term prices are relatively static. This makes sense for miners (as the inflation will typically be offset by their costs) but it underappreciates this is a benefit to royalty owners.

Value Latency

We seek to invest in Mineral Royalties when they trade at a 6-8% free cash flow yield (on long-term commodity price assumptions) but with embedded latencies that could deliver materially higher than this. The sources of value latencies are resource life extensions, volume expansions, new discoveries and capital allocation.

Focused Management Behaviour

We codified the behavioural attributes of exceptional royalty leaders, observing they have a rare mix of:

- Deep technical skills: they understand the most attractive resource opportunities, where the hidden and emergent value lies.

- Intuitive understanding of value creation: a deep, intuitive understanding of the option value that drives royalty value.

- First principles thinker: spend most of their time alone studying, charting their course for which they are laser focused.

- Patient, counter cyclical investors: able to behave counter-cyclically being patient for long periods and then moving aggressively when opportunity presents. We would suggest, it’s hard to be this without the first three.

By contrast, most of the industry is filled with financiers, their starting point is relying on external consultants for technical expertise. They have built portfolios filled with lower quality, short term assets that lack optionality and have limited capital allocation potential.

Capital Preservation

As we have stated capital preservation is a key precept of the Endeavour Fund. So you might ask, how does this apply to an investment driven by highly volatile commodity price? We have concluded a small number of royalty companies have excellent capital preservation characteristics and paradoxically the underlying volatility in their share price supports, rather than detracts from this. This is due to Royalty assets continuing to produce healthy free cash flow even during commodity price down cycles which provides the opportunity for management to deploy this capital into investments that are highly correlated to the commodity price (e.g., their own stock or additional royalty assets).

As returns are driven by asset quality and management talent, there is a very limited number of opportunities. This means we foresee long-term returns following a power law – the best opportunities will accrue significantly higher returns, supporting our approach of heavy due-diligence and concentrated investing.

We would encourage you to think of our Royalty holdings as a very long-term holding. We are unlikely to sell shares (outside valuation extremes) but will add to the positions when the market provides the opportunity. When the relevant commodity price is high the dividends and stock price will likely follow. But there will also be periods when they are low and we are reporting their share prices have fallen materially. When we do, think of what the management teams are doing in the background to increase the value of our investment.

¹ https://www.usinflationcalculator.com/.