Geoff Di Felice & Marcus Guzzardi

This is an extract from the Endeavour Fund’s half year 2024 investor letter.

Frontier Communications is our largest Reversionary investment. The US-based company traces its history back close to ninety years and by the 1990s was focused on telecommunications. By then broadband had been an attractive growth market for many years and hubris started to creep in. Management of the day believed their earnings to be highly resilient and built a financial model consistent with this – high debt and high dividends.

However, most of Frontier’s asset base remained in legacy copper-based technology which did not compete well against cable in the growing high-speed broadband market. Further, given their over-leveraged balance sheet Frontier could not invest in their network to upgrade their technology. This led to a debt spiral, as Frontier begun to lose customers their debt burden grew, ultimately leading to bankruptcy in 2020.

With the bankruptcy process the humility cycle commenced. Frontier restructured their balance sheet, recruited a new management team, and developed a strategy to upgrade their network and revamp their customer service. The company re-listed in 2021 under the ticker FYBR (“Fibre”).

Underappreciated Talent

When we assess the management team of a low risk turnaround, we look to invest alongside management teams who are both industry and turnaround specialists but importantly exhibit behavioural characteristics that include¹:

- master communicators

- teachers who create leaders

- create execution focused mindsets.

Frontier attracted exceptional industry and turnaround specialists in Executive Chairman John Stratton (25-year career as a President of Verizon) and CEO Nick Jeffrey (30 years, including turning around Vodafone UK). And around them built a first-class team of executives and board members.

Then through the relationship we’ve built with the company we have been able to observe their behaviours, this included in one of our early meetings with Frontier they described to us a Friday afternoon ritual instituted by Nick. He would take the entire executive team to spend the last two hours of each week with the customer service team reviewing all the pain points from the week. This anecdote deeply resonated with us – it was a powerful communication tool, it was a teaching moment and it instilled a cadence of performance measurement.

How was Frontier, a recently bankrupt small cap telco which hadn’t grown earnings for close to a decade, able to attract a management team of this calibre? The value creation opportunity of deploying fibre at Frontier is highly unique amongst low growth telcos and the remuneration structure carves out six percent of equity for management, giving them the ability to share in this value.

Inevitable Industry Trends

Fibre networks provide broadband connectivity, which is both highly resilient and growing (+20% growth in traffic per annum). Over the long term, Cable has taken all the broadband industry’s incremental subscribers in what has evolved to be a de facto monopoly.

Today the broadband market is reasonably mature. Broadband penetration is c. 85% of households with cable holding c.65% market share. Industry revenues should reliably grow in the mid-single digit range driven by a combination of pricing growth and modest contributions from penetration and household formation.

However, under the surface there are several moving parts. Fibre is increasingly asserting itself as the superior and necessary broadband technology to serve the ever-growing data consumption by offering faster speeds, symmetrical performance (download/upload) and greater reliability than cable (it’s also cheaper to operate and maintain). Fixed Wireless Broadband (FWB) continues to expand aggressively and now accounts for c.5% market share2.

Given this backdrop, Frontier’s strategy is straightforward – to upgrade their existing copper network to fibre and then reach a terminal penetration of 45% (50% market share, 90% market broadband adoption) by selling a superior product at the market price.

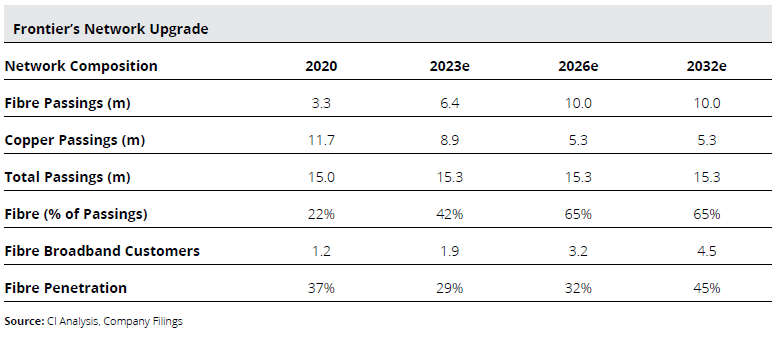

Frontier started the build in 2021 with a network passing c.15m locations, of which c.12m were served by copper and c.3m by fibre. By the end of 2026 we expect Frontier will have replaced c.7m of these copper locations with fibre. The network will then consist of 10m fibre passings and 5m legacy copper passings. As of today, the build is about two and half years in, with over 40% of the network in fibre. It should then take four to five years to fill the network with customers and reach the expected terminal penetration of 45%.

Financial Quality

In assessing financial quality our objective is to understand the earnings, returns and balance sheet quality of a business. We do this through observing both the financial track record as well as the incremental or unit economics which provides insights into changes and trends in financial quality. We assess the balance sheet as a source of both latency and risk.

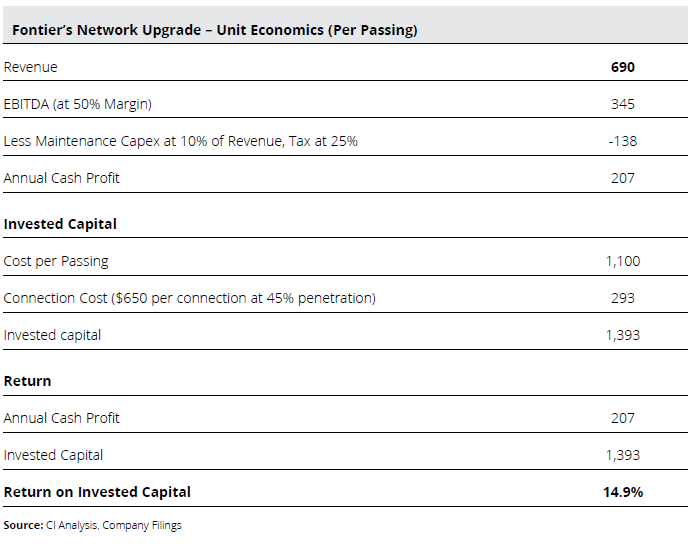

Frontier’s longer term track record is certainly underwhelming – earnings have been declining for many years. Further, current free cash flow is negative owing to the rollout of the fibre network. But the unit economics of Frontier’s fibre deployment are very attractive, especially for a project of this scale. Our analysis suggests that the project should generate an unlevered return in the mid-teens.

We think of Frontier’s financial profile as a roll-out which is where capital is deployed in a repeatable and modular fashion. Other examples include retail or restaurant store rollouts (e.g. Starbucks or Walmart) which over time have proven to be some of the highest returning investments in listed markets. Successful roll-out opportunities should have a stable demand profile, attractive unit economics and a meaningful scope to deploy capital at these economics. Frontier’s broadband roll-out fits the bill.

The majority (85%+) of revenues are earned by selling broadband to residential consumers, which is a function of Revenue per Customer and Penetration of customers on the network. As at the end of 2023 Frontier are a little under halfway through the build. Our de-risking observations around the important inputs to the project’s returns are as follows:

- Revenue per Customer – pricing remains rational in a duopoly market structure (for high-speed products) with pricing growing at a mid-single-digits across the industry supported by a more inflationary environment.

- Penetration – Frontier expect a terminal penetration of 45%. In Frontier’s legacy fibre footprint (which had historically been very poorly managed) penetration is currently 44% (and growing). For the newly built fibre, penetration rates are tracking in line with expectations – for example penetration of the fibre deployed in 2022 is in the high-teens within the first year.

- Cost to Build – costs are running higher than originally expected. We now expect that the cost per passing will be c.15% higher for the remainder of the build. Labour is the primary cost which has been in tight supply. We note the clear offset here with Frontier able to recoup these additional build costs through moderate annual price increases.

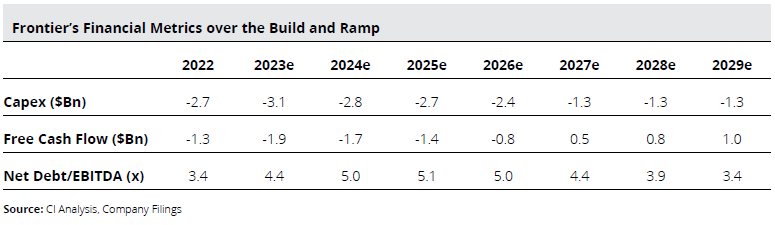

A project of this scale requires capital. Understanding the requirements of sources of this funding has formed another important leg of our financial quality analysis. As of today, what was in 2021 a “to be determined” funding risk has evolved into a strategic advantage. Frontier has been able to access very attractive securitised funding by using its pre-existing fibre assets as collateral. Through the combination of internally generated cash flow and this funding, Frontier already have liquidity to build to c.9m fibre passings (or up to the end of 2025). We expect the funding required for the remaining 1m passings to be arranged well ahead of time but not so early as to impose unnecessary interest costs. This favourable funding position is another unique attribute of the Frontier build in a world where capital is much harder to come by.

As the build costs roll off and the network matures there will be a wall of free cash flow coming to shareholders. Over the next few years credit metrics (Net Debt/EBITDA) will weaken. But we believe this overstates leverage due to the ramp up effect – the debt is drawn and the fibre built but it takes four to five years to ramp and reach steady state EBITDA (and up to two years to break even). Therefore, there is embedded value not reflected in the EBITDA. We think a more useful way to think about the funding is that each passing is funded roughly 50:50 with internally generated cash flow and debt. This is appropriate for a project of this type.

Value Latency

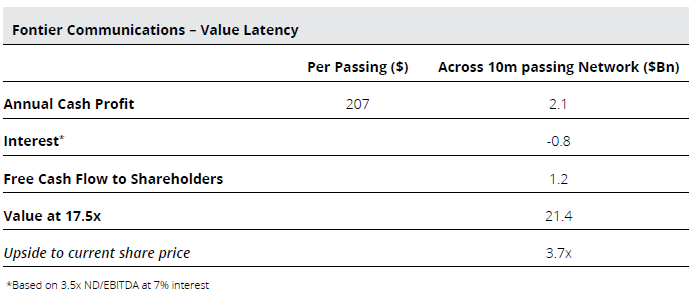

Using a broad range of valuation metrics (strategic takeout, listed peer multiples, discounted cash flow valuation), it is almost inescapable to conclude that the fully built fibre network will be worth tens of billions of dollars – multiples of Frontier’s current value.

To demonstrate this simply if we take the unit economics outlined above and scale it up for the entire fibre network of ten million passings then the total annual free cash flow to shareholders will be c$1.2bn. Frontier will generate a highly resilient stream of subscription revenues at high margin which we believe will warrant at least a market multiple of 17.5x. Then the stock is worth nearly 4x its current value.

Beyond this simple illustration of value there are material latencies including historical operating losses which will shield cash taxes until the end of the decade, capital return via buybacks improving per share free cash flow, better profitability, higher penetration and additional copper upgrades through acquisitions or access to government infrastructure funding as well as the opportunity to better serve business customers.

A fibre network passing 10m locations across the US also has significant strategic value for other large telcos looking for fixed infrastructure to complement their wireless networks in offering a converged product. Additionally, we believe the cash profile of the completed network would also be very appealing to infrastructure or pension funds.

¹ We wrote about these in our post titled Lessons from Railroader in December 2022.

2 FWB uses wireless spectrum (as opposed to fixed networks) to provide broadband connectively to those who are ultimately likely to be value conscious moderate use customers. There are also unavoidable technical and economic limitations. Put simply it is c.20% the speed of a fibre connection and monetises the spectrum at upwards of 20x less than if used to offer mobile services.

We note the recent example provided by cable company Comcast who disclosed that NFL Thursday Night Football which is delivered on streaming platform Amazon Prime subsequently accounts for a quarter of cable network total capacity during gametime. FWB networks are incapable of serving this demand beyond a very small cohort of customers. Fibre can do it just fine.