Allan Goldstein

Portfolio Manager

Family & Founder Fund

The Art of Compounding

Mitchell Rales, one of the brothers who founded, ran and stewarded Danaher over the last 40 years appeared on a recent podcast, ‘The Art of Investing’. Mitch has rarely spoken publicly and his reflection on Danaher and business are a must listen to.

His episode, titled ‘The Art of Compounding’, is a podcast worth sharing, as Danaher was the inspiration for the Cooper Investors Family & Founder Fund portfolio.

“It all starts with creating a purpose statement, a set of core values, a vision statement of what you stand for and a BHAG or big hairy audacious goal, which is what you really aspire to over a 20- to 30-year period of time….

We also think institutions of greatness aren’t, once again, built quickly. You can’t be great quickly. Great takes time and compounding. So, this journey of 30 years to get to that point is what we’re really after, and that’s the ‘BHAG’ that we want. We want to create something that doesn’t exist anywhere else in the world.”

Mitch Rales, The Art of Compounding April 2024

The Rales Brothers in 1988 (The Washington Post)

Skin and Soul in the Game

The Cooper Investors (“CI”) Family and Founder Fund (“F&F Fund”) started as a conversation in 2014 in the back of a taxi between Peter Cooper, CI Founder & CIO, and F&F Portfolio Manager Allan Goldstein. They were on a research trip for the CI Global Equities Fund, and the conversation started following a factory visit to one of Danaher’s operations in the outer suburbs of Illinois, a stock owned since 2010. The visit highlighted the business quality, management capabilities and value latency for shareholders. The Danaher business system was real. The conviction levels in the stock were high and the idea of a dedicated portfolio of only these rare, listed, founder and family businesses first took hold. Albeit it was not for another five years of deep research until the F&F portfolio was established.

Academic research has tried to cover the edge, long-term orientation and statistical outperformance of family and founder-led businesses, but it’s only when you have the opportunity to meet these exceptional business leaders that you really understand the brilliance and inherent sustainability of the business. The story of Danaher is one which resonates with us because it talks directly to our CI approach of both ‘soul and skin in the game’.

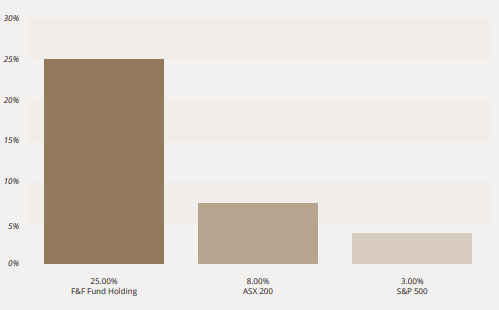

Average Insider Ownership Comparison

We consider this a term which encapsulates the unique passion and energy brought to Family and Founder-led businesses. Over our 23-year journey as CI, and many more years as individual investors, our observations led us to establish and personally seed the F&F in 2019. In the 10 years prior to starting the Fund, a number of top contributors to CI’s global investing performance included emerging founder or family businesses such as Constellation Software, Heico, Techtronic, Colliers, in addition to Danaher.

These companies were bought in the $2-10bn market cap range where they had sufficient scale and track record but still a long runway of value creation, and contributed significantly to the 14% pa returns and 2% alpha pa of the Fund between 2010 and 2020.

After decades of investment observation which has taken us all over the world (around 1,000 individual company visits a year over the past 20 years), it had become apparent to us that there was a captive opportunity to invest in listed founder and family businesses. With an average inside ownership of 25%, the Family & Founder Fund is seeking those businesses with unique levels of skin in the game.

The Danaher Origin Story

“For me, it all starts with does the business have a platform to do something special over the course of time. If we understand that, that’s the case, then the first thing I want to do is, I want to meet the CEO/founder running the business, and I want to really size him or her up.”

Mitch Rales, The Art of Compounding April 2024

Danaher was established by brothers Steven and Mitchell Rales in 1984, evolving from a niche industrial company to a leading healthcare business over its 40 years. Its origins were as discrete and disparate manufacturing businesses, which grew into Danaher Business Systems: a global technology and science sector leader.

Today, Danaher has a portfolio of 15 businesses across biotechnology, diagnostics and life sciences, and more than 65,000 employees around the world. But it still retains its essence with Steven and Mitchell Rales as the stewards of the company culture and strategy, combining a unique blend of commercial excellence and a savvy acquisition focus.

When talking about company culture recently, Mitch Rales speaks to the importance of a mindset of continuous improvement and long-term thinking; and how important this is to Danaher and the company’s DNA. These cultural indicators have been a significant feature of why CI has been a longstanding supporter of Danaher and continues to invest to this day, with a strong alignment between the F&F fund mandate and the Danaher approach.

“We started this imagination journey…

And it basically went along the lines of, we want to find passionate and dedicated founders who can give you a long duration runway, think 20 to 30 years, where you invest in businesses that have the chance to create a 50 to 100x outcome over those 20 to 30 years and stay the course.”

Mitch Rales, The Art of Compounding April 2024

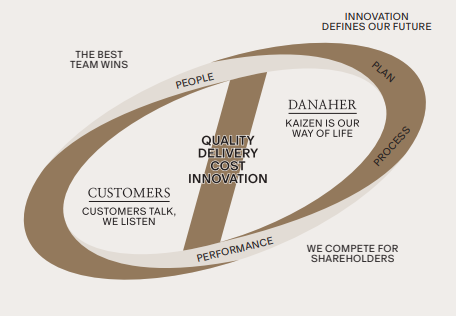

The Danaher Business System and Values

CI invested in Danaher in 2010 – almost 15 years ago. At that time, Danaher was a $25bn market cap company (having listed in 1979 and the brothers taking control in 1984). The company had begun to show signs of pivoting from a niche industrial company into one focused on the manufacture of scientific and technical instruments, under the ‘crown jewel’ platform of the Danaher Business Systems: guidelines for identifying and implementing continuous improvement.

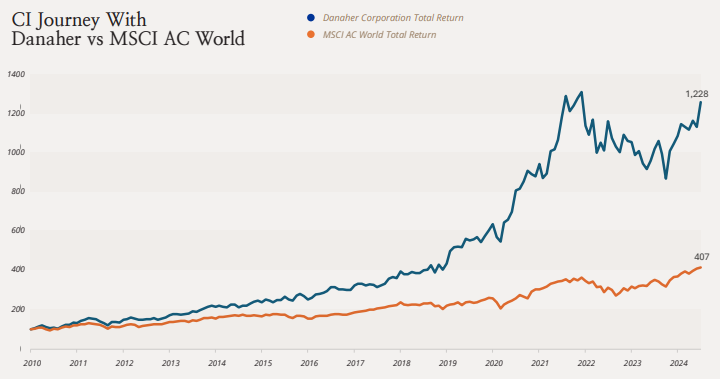

The price at which CI bought in was $27 (adjusting for spin offs) in mid-2010. Early indications were strong, however in 2011, the stock underperformed by 20%. Nearly 1.5 years into the investment, the stock had not generated any return or outperformance.

Our focus was on the strong underlying fundamentals and the vision for the business and growth that Danaher had outlined, and we knew we were investing for the journey – CI looks to find underappreciated sources of value. Supported by the thesis, Danaher then began a steady growth trajectory that saw the stock price double by 2015 from CI’s original buy-in price five years previous. From here, the steady trajectory became a significant performance run, as more recurring, higher margin business came through and re-ratings followed superior earnings per share (EPS) growth.

Since our original investment, Danaher has been a ‘ten-bagger’¹ for CI, a stock entered into at $27 which is now valued at $255 USD, plus another ~$15 of dividends distributed along the journey. As of March 2024, the market cap of Danaher Corp (NYSE: DHR) is $190 billion, even after accounting for major spin offs (Danaher’s market cap is now bigger than that of BHP, the ASXs largest stock).

Whilst the financial return and the fruition of our investment thesis is welcome, it is the underlying cultural alignment between CI and Danaher that sees us waking up every day thinking about who the next Danaher is to add to the F&F Fund portfolio.

¹ A ‘Ten-Bagger’ is a colloquial term coined by legendary fund manager Peter Lynch in his book ‘One Up on Wall Street.’ It refers to a stock which has appreciated in value ten-times (or more) from its original purchase price.

Past performance is not a reliable indicator of future performance Source: Factset

Making Growth Happen: M&A and a Culture as Platform

The incredible growth was made possible through an organic strategy, but M&A was also a big value creation driver alongside the core business. M&A made the business ‘better’ whilst generating attractive returns. We regularly visited Danaher portfolio businesses and spoke to company executives and saw this evolution taking shape – as bolt-ons and new platforms came online, Danaher also divested its industrial and dental businesses to become a more focused healthcare business. The pace at which they were able to implement their vision was impressive, again underpinned by their culture of continuous improvement.

A watershed moment for our team was that on the ground tour of Videojet in 2014. Videojet provides marking and coding for in line printing i.e. the use by date or product code for a soft-drink can. Videojet was a business acquired by Danaher in 2002, which became the foundation for Danaher’s Product Identification Platform. The site tour brought to life Danaher’s ability to identify quality companies and add value to businesses.

Intensely private, the brothers Mitchell and Stephen do not engage in public and shareholder events nor accept speaking engagements. An external CEO was appointed very early on in the Danaher journey, with the brothers transitioning to ‘chief stewards’ of the business.

As part of the ‘Art of Investing’ podcast, Mitch reflected on this journey:

“The story starts with the fact that I think Steve and I understood what we didn’t know. We were not meant to be great operators…. I think we understood that we really needed to professionalise the business. We could create long-term vision and strategy and how to properly allocate capital. We were very good at those type of things.

But the details of what you need to do to run a business day to day is a heavy lift. As a CEO of a publicly traded company, it really requires you to be in 24/7, 365 days a year. And we’re prepared to commit the time and the energy, but the details were something that really needed to be paid attention to.”

Steven and Mitchell Rales Source: Getty Images

The first CEO was George Sherman who was appointed in 1990. Mitch says: “George gave us a great 10-year run. He was an exceptional CEO. He professionalised the business. He brought processes in. He helped us roll out the Danaher business system in meaningful ways that were really important to becoming the culture of the organization, our DNA.”

Through this strong culture, Danaher has successfully navigated several CEO successions over its history, and to this day Steven and Mitchell hold Executive Chairman roles at Danaher.

Attributing Success

In our years observing Danaher, speaking with their executives, and relentlessly researching their stock we consider that there are three key attributes to Danaher’s success:

- Operational Excellence/Continuous ImprovementThis is a way of life at Danaher. They serve their customers well, expand their margins, generate strong cash flows, and reinvest in the business – it is a virtuous cycle. The level of talent in their leadership positions is outstanding, but they also ‘grow their own’ with strong talent building and identification programmes.

- Capital DeploymentFrom the very early days, the majority of free cash flow at Danaher has gone into acquisitions. The team have generated attractive returns by buying quality businesses that have a unique adjacency to the Danaher Business System.

- Building a Better BusinessThe vision from the Rales brothers has been strong from day one, and the evolution from a niche industrial company to a leading healthcare business came through organic growth, M&A, and also strategic divestment.

The next Frontier of Danaher and F&F

“I guess I’m just a business builder rather than a business seller. And if we can find those shots on goal that give us a percent recreating something special, I think the returns will take care of themselves over time.”

Mitch Rales, The Art of Compounding April 2024

Today F&F is relentlessly focused on researching and finding underappreciated value in founder-led businesses, sitting alongside the enduring family company in a single portfolio. We consider that several platforms we currently have in the portfolio support this thesis and have the potential to grow – a combination of operational excellence, capital deployment, and getting better (not just bigger).

My personal experience, growing up in a small family business, and passion as an investor drives the continued search for quality businesses to add to the Family & Founder Fund.